Faysal Bank Personal Loan Scheme 2024

Faysal Bank offers a Shariah-compliant personal loan scheme through its “Faysal Islami Personal Finance” program, designed to provide economic support for needs like education, marriages, medical overheads, and more. Here’s an all-inclusive guide that covers the loan’s features, eligibility, application process, and other key details for those interested in availing of this service in Pakistan.

Read More:Chief Minister Punjab Skill Development Program

Quick Overview Table

| Feature | Details |

| Program Name | Faysal Islami Personal Finance |

| Loan Amount | PKR 50,000 – PKR 4,000,000 |

| Tenure | 1 to 4 years |

| Profit Rate | Fixed |

| Processing Fee | PKR 7,000 + FED |

| Application Method | Online, Branch Visit, or SMS |

| Eligibility Age | 18 – 70 years |

| Minimum Income | Salaried: PKR 50,000/month; Self-employed: PKR 100,000/month |

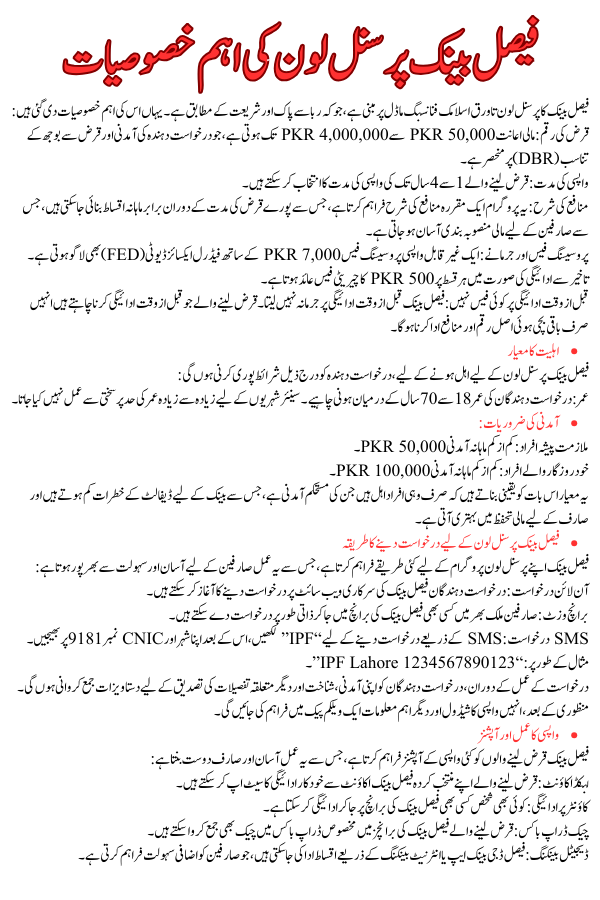

Key Features of Faysal Bank Personal Loan

Faysal Bank’s personal loan scheme is based on the Tawarruq Islamic backing model, ensuring a Riba-free, Shariah-compliant structure. Here are the main features:

- Loan Amount: Financing ranges from PKR 50,000 to PKR 4,000,000, depending on the applicant’s income and debt-to-burden ratio (DBR).

- Repayment Tenure: Borrowers can select a repayment period of 1 to 4 years.

- Profit Rate: The program offers a fixed profit rate, agreeing for equal monthly sections throughout the loan period, making simpler financial planning for customers.

- Processing Fees and Penalties: A non-refundable processing fee of PKR 7,000 plus Federal Excise Duty (FED) applies. Late payment incurs a charity fee of PKR 500 per missed installment.

- No Early Settlement Fees: Faysal Bank does not charge a penalty for early repayment. Borrowers who wish to repay early only need to cover the remaining principal and profit amount.

Read More: Interest-Free Loans for Punjab Farmers

Eligibility Criteria

To qualify for the Faysal Bank Personal Loan, applicants need to meet the following criteria:

- Age: Applicants must be between 18 and 70 years old. For senior citizens, the maximum age limit is not strictly applied.

- Income Requirements:

- Salaried Individuals: Minimum monthly income of PKR 50,000.

- Self-Employed Individuals: Minimum monthly income of PKR 100,000.

The eligibility criteria ensure that only those with stable incomes are eligible, thereby reducing default risks for the bank and improving financial security for the customer.

Read More:KPK Housing Authority Jobs 2024

How to Apply for a Faysal Bank Personal Loan

Faysal Bank provides multiple options to apply for their loan program, making the process available and convenient:

- Online Application: Applicants can begin the application process on Faysal Bank’s official website.

- Branch Visit: Customers can visit any Faysal Bank branch nationwide to apply in person.

- SMS Application: To apply via SMS, send “IPF” followed by your city name and CNIC number to 9181. For example: “IPF Lahore 1234567890123.”

During the application process, applicants are required to submit a certification to verify their income, identity, and other applicable details. After approval, they will receive a repayment program and other key information in a welcome pack.

Read More: Green Tractor Scheme Qurandazi List

Repayment Process and Options

Faysal Bank provides several repayment options for borrowers to make the process flexible and user-friendly:

- Linked Account: Borrowers can set up automatic payments from their chosen Faysal Bank account.

- Over-the-Counter Payment: Payments can also be made by visiting any Faysal Bank branch.

- Cheque Drop Box: Borrowers can deposit a cheque in a selected drop box at Faysal Bank branches.

- Digital Banking: Installments can be paid through the Faysal Digibank app or Internet banking for added convenience.

Benefits of Faysal Bank’s Personal Loan Scheme

Faysal Bank’s personal loan scheme is popular among individuals who require financial support without the complications of old loans. Here are some benefits:

- Shariah Compliance: As a Riba-free financing option, it aligns with Islamic banking principles, making it ideal for those who prefer Shariah-compliant services.

- Fixed Monthly Installments: The fixed profit rate allows predictable and stable monthly payments, eliminating the risks of variable rates.

- Easy Accessibility: With multiple application methods, the process is efficient for both tech-savvy individuals and those who prefer traditional banking.

- Flexible Repayment Options: The accessibility of multiple payment channels simplifies the repayment process for borrowers.

Frequently Asked Questions

- Can I repay the loan early?

Yes, early repayment is allowed without any additional fees. Borrowers need only clear the remaining principal and profit amount. - Are there any penalties for late payments?

Yes, a PKR 500 charity fee is applied for each missed payment as part of the late payment policy. - When are the monthly payments due?

Borrowers can choose between two installment dates, either the 1st or 15th of each month, at the time of application. - How do I check my repayment schedule?

After loan disbursal, borrowers receive a repayment plan detailing the installment amounts and due dates. - Can I apply if I am self-employed?

Yes, self-employed individuals can apply, provided they meet the minimum monthly income requirement of PKR 100,000.

Read More: Ehsaas Tahafuz Program Check Online Registration 2024

Conclusion

Faysal Bank’s Personal Loan Scheme is a smart option for Pakistanis in need of a Shariah-compliant, suitable, and flexible economic solution. With loan amounts up to PKR 4 million, fixed monthly payments, and easy application options, this loan scheme is designed to cater to diverse financial needs without banding on Islamic values.