Interest-Free Loan Scheme for Employees

The Government of Khyber Pakhtunkhwa (KPK) has newly introduced a much-awaited creativity for government employees across the region: the Interest-Free Loan Scheme for Employees 2024-25. This program aims to provide business support to public area employees facing economic challenges. With no interest on repayment, the scheme is designed to ease financial burdens, helping employees manage costs, hold duty, and improve their quality of life. Here, we’ll explore the scheme’s details, eligibility criteria, application process, and much more to ensure you have complete information.

More Read :Facilities for BISP Beneficiaries

Quick Information Table

| Name of Program | Interest-Free Loan Scheme for Employees 2024-25 |

| Start Date | To be announced |

| End Date | To be announced |

| Loan Amount | Up to PKR 500,000 |

| Repayment Period | Flexible, up to 5 years |

| Application Method | Online and Offline |

| Eligibility | KPK government employees |

| Interest Rate | Zero interest |

| Approval Time | Within 30 days of application |

Interest-Free Loan Scheme for Employees

This scheme is a important move by the KPK government to develop the well-being of its public sector employees. With rising costs of living and limited salary growth, government employees often find it challenging to meet personal expenses. This interest-free loan scheme is specifically designed to address such worries, enabling employees to take financial aid without worrying about high interest rates.

The funds can be used for various purposes, such as:

- Medical expenses

- Children’s education

- Debt consolidation

- Housing improvements

In addition to the zero-interest feature, the program also allows employees to repay the loan over a flexible period of up to five years, ensuring that it does not deeply impact their monthly budget.

More Read :CM Punjab Launches Wheat Cultivation Program

Full Details of KPK Interest-Free Loan Program

The KPK government has outlined clear details for this scheme to make the process straightforward and accessible. Here’s a breakdown of the program’s primary features:

- Loan Amount: The maximum loan amount is PKR 500,000, subject on the employee’s salary scale and specific needs.

- Repayment Terms: The repayment period is flexible, with options ranging from one to five years.

- Zero Interest: There is no interest on the loan, making repayment convenient for all eligible employees.

- Approval Process: The loan application is processed within 30 days of submission to ensure timely disbursement.

- Disbursement: The approved loan amount will be directly deposited into the applicant’s bank account.

This creativity is expected to benefit thousands of employees across various departments in KPK, helping them realize financial stability.

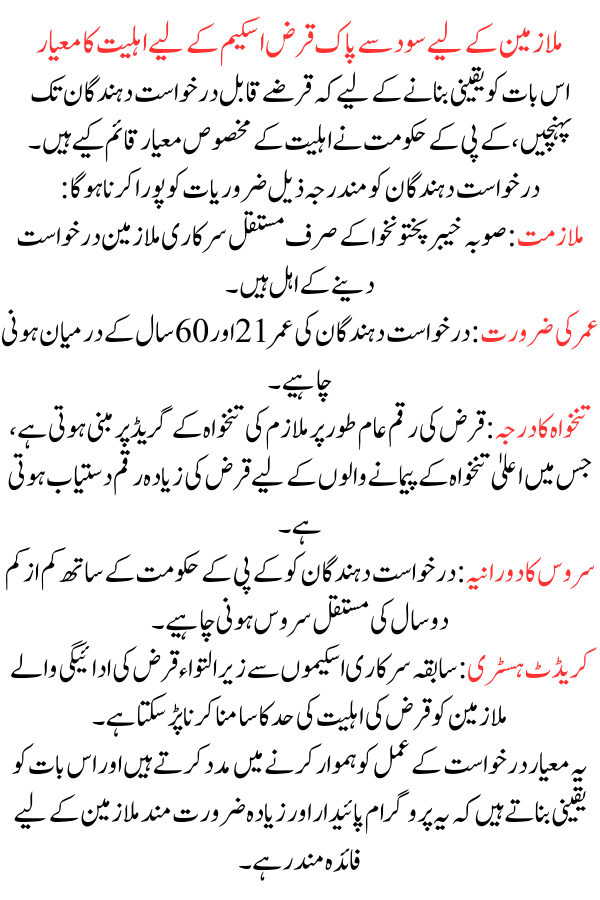

Eligibility Criteria for Interest-Free Loan Scheme for Employees

To ensure that the loans reach worthy applicants, the KPK government has established specific eligibility criteria. Applicants must meet the following requirements:

- Employment: Only permanent government employees of Khyber Pakhtunkhwa province are eligible to apply.

- Age Requirement: Applicants must be between 21 and 60 years of age.

- Salary Grade: The loan amount is typically based on the employee’s salary grade, with higher loan amounts available for those in higher pay scales.

- Service Duration: Applicants should have at least two years of constant service with the KPK government.

- Credit History: Employees with pending loan repayments from previous government schemes may face limits on loan eligibility.

These criteria help streamline the application process and ensure that the program remains sustainable and beneficial for employees most in need.

More Read :KP Free Meal Programme

Application Process for KPK Interest-Free Loan Scheme for Employees

The KPK government has made it suitable for employees to apply through both online and offline methods. Here’s a step-by-step guide to the application process:

Online Application

- Visit the Official Website: Go to the KPK government’s official portal or the designated finance department website.

- Create an Account: Register on the portal using your CNIC and employee ID.

- Fill Out the Application Form: Complete the application form by providing details such as salary, employment status, and loan amount required.

- Upload Documents: Attach the required documents, including proof of service and recent salary slips.

- Submit: Once all details are provided, submit the application for review.

Offline Application

- Collect the Application Form: Visit your department’s HR office or the money department to collect a physical form.

- Fill and Submit: Complete the form manually and attach necessary documents, then submit it to your department’s designated focal person.

- Acknowledgement: You will receive an greeting slip or receipt to track your application status.

Applications are processed within 30 days, and successful applicants are notified through official channels.

Required Documents for the KPK Interest-Free Loan Scheme

The application requires some essential documents for confirmation purposes. Here’s a list of required documents:

- CNIC Copy: A clear copy of the applicant’s CNIC (Computerized National Identity Card).

- Employee ID: Proof of government employment status.

- Service Certificate: Document confirming the duration of service, signed by the HR department.

- Salary Slips: Latest three months’ salary slips to verify income and loan eligibility.

- Bank Account Details: An active bank account to receive loan funds.

These documents help verify the applicant’s eligibility and ensure that funds are allocated to deserving employees.

More Read :Ehsaas Apna Ghar Program in KPK

Submission Deadlines for KPK Interest-Free Loan Scheme

The government has not yet announced the final deadlines for the scheme, but it is expected to commence early in the fiscal year and run until the billed budget is tired. Applicants are advised to submit their applications as early as possible to secure their place in the program. Updates regarding limits are naturally posted on the official KPK government website, as well as through departmental messages.

Benefits of the KPK Interest-Free Loan Scheme

The KPK Interest-Free Loan Scheme is anticipated to have a significant positive impact on the lives of public sector employees. The scheme offers multiple benefits, such as:

- Financial Relief: Enables employees to meet emergency expenses without resorting to high-interest loans.

- No Interest Charges: Repayments are manageable since the loan is interest-free.

- Flexible Repayment Plans: Offers employees the flexibility to repay the loan based on their convenience.

- Support for Key Expenses: Funds can be used for essential needs like medical emergencies, education fees, and debt consolidation.

More Read :Prime Minister Youth Skill Development Program

The scheme aims to support government employees in leading a financially secure and stress-free life.

conclusion

In conclusion, the KPK government’s Interest-Free Loan Scheme for Employees 2024-25 is a advanced step toward employee welfare, offering financial support without the burden of interest. This creativity ensures that employees have access to funds in times of need, enabling them to focus on their duties with peace of mind. With a straightforward application process and generous eligibility requirements, the program is a golden chance for KPK employees to secure interest-free financial assistance. For additional details and updates, employees are cheered to keep an eye on official messages.