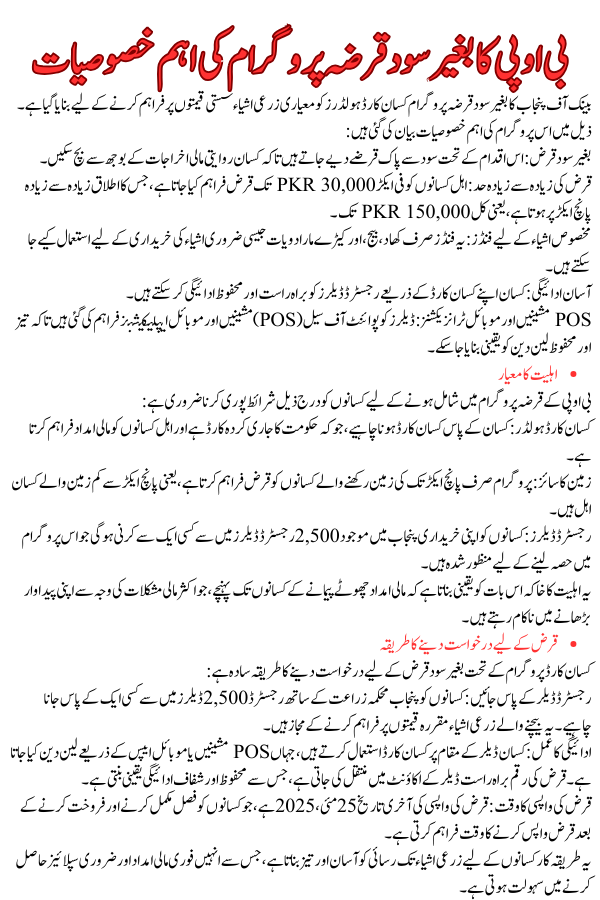

Interest-Free Loans for Punjab Farmers

To support Pakistan’s agricultural sector and ease the financial burden on farmers, the Bank of Punjab (BOP), in collaboration with the Punjab Department of Agriculture, has launched an interest-free loan program exactly tailored for farmers who possess a Kisan Card. This initiative provides financial support that allows farmers to purchase essential farmed inputs like fertilizers, seeds, and pesticides for the Rabi season. The program seeks to increase agricultural yield and support Pakistan’s economy by empowering farmers through easy entry to quality farming supplies.

Read More: Green Tractor Scheme Qurandazi List

Quick Overview of the Loan Program

| Program | BOP Interest-Free Loan for Kisan Card Holders |

| Start Date | October 17, 2024 |

| End Date | May 25, 2025 (for loan repayment) |

| Maximum Loan Amount | PKR 150,000 (for up to 5 acres) |

| Per Acre Loan | PKR 30,000 |

| Application Mode | Offline via registered dealers |

| Loan Purpose | Fertilizers, seeds, and pesticides |

| Dealer Network | 2,500+ dealers across Punjab |

Key Features of the BOP Interest-Free Loan Program

The Bank of Punjab’s interest-free loan scheme is designed to make high-quality farming inputs near to Kisan Cardholders at controlled prices. The following features highlight the benefits of this program:

- Interest-Free Loan: This initiative provides loans without interest, helping farmers avoid the burden of traditional financing costs.

- Maximum Loan Amount: Eligible farmers can receive up to PKR 30,000 per acre, covering up to five acres, with a maximum limit of PKR 150,000.

- Targeted Inputs: The funds can only be used for buying essential items such as fertilizers, seeds, and pesticides.

- Ease of Payment: Farmers can utilize their Kisan Cards to make secure, direct payments to registered dealers.

- POS Machines and Mobile Transactions: Dealers are equipped with Point of Sale (POS) machines and mobile applications to facilitate fast and secure transactions.

Eligibility Criteria for Interest-Free Loans for Punjab Farmers

To participate in the Interest-Free Loans for Punjab Farmers, farmers must meet the following requirements:

- Kisan Card Holder: The farmer must possess a Kisan Card, which is a government-issued card that provides financial support and support to eligible farmers.

- Land Size: The program supports loans for up to five acres of land, so only farmers with five acres or less are eligible.

- Registered Dealers: Farmers must purchase inputs from one of the 2,500 registered dealers in Punjab who are approved to contribute to the program.

This eligibility outline ensures that the financial aid is targeted to small-scale farmers, who often face financial limits that hinder their yield.

Read More: Faysal Bank Personal Loan Scheme 2024

How to Apply for Interest-Free Loans for Punjab Farmers

The application process for the Interest-Free Loans for Punjab Farmers under the Kisan Card program is direct:

- Visit a Registered Dealer: Farmers should go to one of the 2,500 dealers registered with the Punjab Department of Agriculture. These sellers are authorized to provide agricultural inputs at exact prices.

- Payment Process: The farmer uses the Kisan Card at the dealer’s location, where POS machines or mobile apps facilitate the matter. The loan amount is removed directly to the dealer’s account, ensuring secure and visible payments.

- Loan Repayment Timeline: The loan repayment deadline is May 25, 2025, allowing farmers time to complete their harvest and sell their produce before repaying the loan.

This process streamlines farmers’ access to inputs, making it easier and faster to receive financial assistance and obtain necessary supplies.

Read More:Ehsaas Tahafuz Program Check Online Registration 2024

Authorized Dealer Network

To make the program accessible, the Punjab Department of Agriculture has registered more than 2,500 dealers across the province. These authorized dealers are strategically located in various cities to ensure all farmers have easy access to supplies. They sell fertilizers, seeds, and pesticides at controlled prices, maintaining affordability and transparency.

- POS Machines: Dealers equipped with POS machines offer a seamless payment experience.

- Mobile App Transactions: Some dealers have mobile applications on their phones for efficient processing, allowing quick and secure transfers of funds.

This extensive dealer network plays a crucial role in ensuring the availability and affordability of quality agricultural inputs

Read More:Chief Minister Punjab Skill Development Program

Benefits of the Interest-Free Loan Program

The BOP interest-free loan program provides several advantages that contribute to both the immediate needs of farmers and the long-term growth of Pakistan’s agricultural sector:

Financial Relief for Farmers

- No Interest Cost: By eliminating interest fees, this program reduces the financial burden on farmers, allowing them to invest more in their crops without worrying about high-interest repayments.

- Timely Assistance: The funds can be accessed immediately, enabling farmers to buy the inputs they need for the Rabi season without delays.

Improved Crop Yields and Productivity

- Access to Quality Inputs: Through the program, farmers have access to high-quality fertilizers, seeds, and pesticides, which can significantly improve crop yields.

- Controlled Pricing: The partnership with registered dealers ensures that prices are regulated, making it more affordable for farmers to access the necessary supplies.

Boost to Pakistan’s Agricultural Sector

This initiative aligns with the government’s vision of bolstering Pakistan’s agricultural output, which is a key component of the country’s economy. By supporting small farmers, this program promotes rural development and food security, contributing to the nation’s economic resilience.

Loan Repayment and Terms

The program requires that farmers repay their loans by May 25, 2025, which marks the end of the Rabi season. This extended repayment timeline allows farmers to complete their harvest, sell their produce, and gather sufficient funds for repayment.

- Flexible Repayment: Farmers can repay the loan in one installment or in parts, depending on their financial capacity.

- No Penalty for Early Repayment: Farmers can repay the loan anytime before the due date without incurring any additional fees.

This flexible repayment schedule is tailored to accommodate the seasonal income cycle of farmers, ensuring they are not pressured during financially challenging periods.

Read More: KPK Housing Authority Jobs 2024

Frequently Asked Questions (FAQs)

- What can I use the loan amount for?

The loan amount can be used to purchase fertilizers, seeds, and pesticides essential for crop cultivation. - How do I find a registered dealer near me?

Farmers can consult with the Punjab Department of Agriculture or check local directories for a list of registered dealers participating in the program. - Can I use the loan amount for other expenses?

No, the funds are specifically allocated for agricultural inputs, ensuring they contribute directly to farming productivity. - What happens if I am unable to repay the loan by May 25, 2025?

In case of repayment difficulties, farmers should contact the Bank of Punjab for guidance. While the terms do not specify penalties, timely repayment is encouraged.

Conclusion

The Bank of Punjab’sInterest-Free Loans for Punjab Farmers is a vital step toward strengthening Pakistan’s agricultural sector. By offering financial assistance through the Kisan Card, this initiative makes it easier for farmers to access necessary supplies at affordable rates, ultimately aiming to boost crop production and support the rural economy. With over 2,500 registered dealers, secure payment options, and a flexible repayment plan, this scheme provides farmers with the essential resources needed for a successful Rabi season.