Meezan Bank Apni Bike Scheme

Meezan Bank, one of Pakistan’s leading Islamic banks, has introduced the Apni Bike Scheme 2024, an interest-free financing plan to help individuals in Pakistan own a bike without any additional financial burden. This unique scheme is designed in accordance with Islamic principles, meaning no riba (interest) is charged on the financing. Under this scheme, you can buy a motorcycle from reputable brands like Honda, Suzuki, Yamaha, and others, with easy installments over 12 to 36 months, depending on the bike model. Whether you’re a salaried person, self-employed, or a businessman, Meezan Bank offers this financing plan with a straightforward application process.

To help you quickly understand the details, here is a table summarizing the key points of the Meezan Bank Apni Bike Scheme 2024.

Check More Info: Apni Chhat Apna Ghar Scheme 15 Lakh Loan

Quick Information Table

| Program Name | Meezan Bank Apni Bike Scheme 2024 |

| Start Date for Apply | January 1, 2024 |

| Last Date for Apply | December 31, 2024 |

| Bank Name | Meezan Bank |

| Total Loan Amount | Up to Rs. 150,000 |

| Return Time | 12 months to 3 years |

| Cities Covered | Karachi, Lahore, Islamabad, Rawalpindi, Peshawar, Faisalabad, and more |

| Province | Pakistan-wide |

| Down Payment | 15% to 50% of the bike’s price |

| Application Method | Online and Offline |

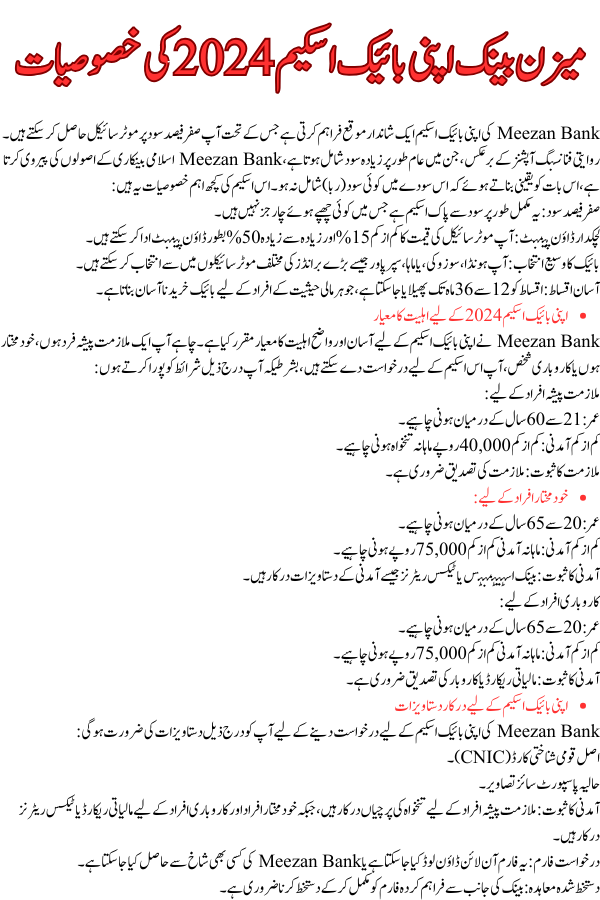

Meezan Bank Apni Bike Scheme 2024 Features

Meezan Bank’s Apni Bike Scheme offers an unbelievable opportunity to own a motorcycle at zero percent interest. Unlike traditional financing options, which often come with hefty interest rates, Meezan Bank adheres to Islamic banking principles, ensuring that there is no interest (riba) involved in the transaction. Here are some key features of the scheme:

- Zero Markup: This is a completely interest-free scheme with no hidden charges.

- Flexible Down Payment: You can pay a minimum of 15% and a maximum of 50% of the bike’s cost as a down payment.

- Wide Range of Bikes: You can choose from a variety of top bike brands including Honda, Suzuki, Yamaha, and Super Power.

- Easy Installments: Installments can be spread over 12 to 36 months, making it easy for individuals from all financial backgrounds to afford.

Eligibility Criteria for Apni Bike Scheme 2024

Meezan Bank has set simple and easy-to-meet eligibility criteria for the Apni Bike Scheme. Whether you are a salaried individual, self-employed, or a businessman, you can apply for this scheme, provided you meet the following conditions:

Check More Info: Zawar Taleem Program Registration

For Salaried Individuals:

- Age: Between 21 and 60 years.

- Minimum Income: Must have a minimum gross salary of Rs. 40,000.

- Employment Proof: Employment verification is required.

For Self-Employed Individuals:

- Age: Between 20 and 65 years.

- Minimum Income: Must have a monthly income of at least Rs. 75,000.

- Income Proof: Documentation of income is required, such as bank statements or tax returns.

For Businessmen:

- Age: Between 20 and 65 years.

- Minimum Income: Should have a monthly income of Rs. 75,000 or more.

- Income Proof: Financial records or business verification is required.

Documents Required for Apni Bike Scheme

To apply for the Apni Bike Scheme, you will need the following documents:

- Original National Identity Card (CNIC).

- Recent Passport-Sized Photographs.

- Proof of Income: For salaried individuals, this includes salary slips, while for self-employed individuals and businessmen, financial statements or tax records are required.

- Application Form: This can be downloaded online or obtained from any Meezan Bank branch.

- Signed Agreement: The form provided by the bank must be completed and signed before submission.

-

Check More Info: Ehsaas Program 10500 Rs Payment Deadline

Cities Included in the Scheme

The Meezan Bank Apni Bike Scheme covers major cities across Pakistan, making it accessible to people from different regions. The scheme is available in:

- Karachi

- Lahore

- Islamabad

- Rawalpindi

- Peshawar

- Faisalabad

Other cities may also be included in the future, depending on demand.

Tenure and Installments

Meezan Bank offers flexible installment plans based on the type of motorcycle and its brand. Here’s what you can expect in terms of repayment periods:

For Japanese Bikes (Honda, Suzuki, Yamaha):

- The installments for Japanese brands can be paid over a period of up to three years (36 months).

For Chinese Bikes (Super Power and others):

- The installments for Chinese brands must be paid within two years (24 months).

This flexibility allows buyers to choose a repayment plan that suits their financial situation, ensuring they don’t face any financial burden while paying for their bike.

Check More Info: CM Punjab Skill Development Program

Application Process for Apni Bike Scheme 2024

The application process for the Meezan Bank Apni Bike Scheme is simple and hassle-free. Here’s a step-by-step guide to help you apply:

Step 1: Download the Application Form

- Visit Meezan Bank’s website or visit any Meezan Bank branch to get the application form for the Apni Bike Scheme.

Step 2: Fill in the Form

- Complete the form with accurate personal, financial, and employment details.

Step 3: Attach Required Documents

- Attach the required documents such as your CNIC, passport-sized photographs, and proof of income.

Step 4: Submit the Form

- Submit the completed application form along with the necessary documents to the nearest Meezan Bank branch.

Step 5: Verification Process

- Once you submit the form, Meezan Bank will verify your information. This process may take 5 to 7 working days.

Step 6: Receive Your Bike

- Once your application is approved, Meezan Bank will purchase the bike on your behalf and hand it over to you. The entire process is quick and smooth, ensuring that you can start using your bike as soon as possible.

Advantages of Meezan Bank Apni Bike Scheme

The Apni Bike Scheme is a unique opportunity for individuals across Pakistan to own a bike without paying any interest. Here are the top benefits of this scheme:

- Interest-Free Financing: The entire loan is provided on zero markup, meaning you don’t have to worry about extra interest payments.

- Islamic Principles: The scheme is strictly based on Shariah-compliant principles, making it a perfect choice for individuals seeking Islamic financing.

- Flexible Repayment Options: You can choose a repayment period of 12 to 36 months, depending on your financial capacity.

- Wide Range of Bikes: Meezan Bank offers financing for all major motorcycle brands, ensuring that you can get the bike of your choice.

- Quick and Easy Application Process: The simple application process allows you to secure your bike within 5 to 7 days.

Conclusion

The Meezan Bank Apni Bike Scheme 2024 is a game-changer for individuals who wish to own a bike without the financial strain of high-interest loans. Offering interest-free financing and flexible repayment options, this scheme is nearby to salaried individuals, self-employed persons, and businessmen alike. The program ensures that you can buy a bike from leading brands such as Honda, Suzuki, Yamaha, and Super Power, all while obeying to Islamic banking principles.

Check More Info: Internship Scheme for Agriculture Graduates

With an easy application process, flexible tenure, and no hidden costs, the Apni Bike Scheme is the perfect solution for those looking to buy a motorcycle in Pakistan. So, if you’ve been dreaming of owning a bike, now is the time to take advantage of this incredible opportunity offered by Meezan Bank.